By Rudy Avizius

OpedNews

The kangaroo courts setup by this TPP agreement will have binding corporate guarantees with both trade and cash sanctions. These cash sanctions would effectively transfer taxpayer money to transnational corporate coffers. Can you imagine the excesses we will see in the financial industry as they challenge regulations within their own private court system forcing governments to pay or eliminate them?

The kangaroo courts setup by this TPP agreement will have binding corporate guarantees with both trade and cash sanctions. These cash sanctions would effectively transfer taxpayer money to transnational corporate coffers. Can you imagine the excesses we will see in the financial industry as they challenge regulations within their own private court system forcing governments to pay or eliminate them?

OpedNews

a leaked copy of the investment chapter for the Trans-Pacific Partnership (TPP) was made public. This copy was analyzed by Public Citizen’s Global Trade Watch and has been verified as authentic. This agreement has been negotiated IN SECRET for 2-1/2 years and no information has ever been released until this leak. So why have the details of this negotiation been so secret? This agreement has been framed as a “free trade” agreement and yet out of 26 chapters only two have anything to do with trade. The other 24 chapters grant new corporate privileges and rights, while limiting governments and protective regulations.

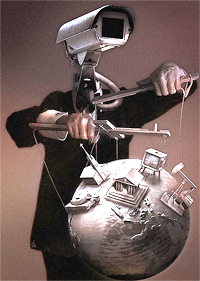

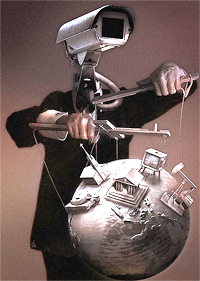

If implemented, this agreement will hard code corporate dominance over sovereign governments into international law that will supercede any federal, state, or local laws of any member country. This TPP agreement alone should set alarm bells ringing, but if one steps back and looks at the larger picture, the future ramifications look even more ominous. After completing this reading, see what your conclusions are.

This video is a must see for anyone who wishes to more fully understand the implications of this secretly negotiated agreement. This article will also show how if this agreement is considered in the context of other recently passed legislation and developments, and the “dots are connected”, the results would be total corporate global governance with an accompanying police state. In this new system the role of elected governments would be to serve as subservient agents for the transnational corporations, while the armies, police, and courts would serve the interests of these transnational corporations. The status of the member states would be locked-in, similar to countries once they are inside the Eurozone.

The TPP is being negotiated by some of the same cast of characters that brought us NAFTA, CAFTA and other so called free trade agreements. Some of the provisions in this document include the establishment of a parallel system of justice to be administered by 3 attorneys with no conflict of interest limitations. This 3 attorney tribunal could order sovereign governments to use taxpayer money to pay these transnational corporations for any environmental or regulatory costs that these corporations expended to meet local standards. Many existing laws would need to be rewritten and no new regulatory laws could be passed.

Governments that tried to pass regulations such as limits on the financial industry using risky bets such as derivatives would have the burden of proof to defend such regulations in a court system controlled by the corporations. The taxpayers would pay should a corporation prevail in one of these “private courts”. In fact over $350 million of taxpayer money has already been paid out to corporations under the NAFTA style deals, because of zoning laws, toxic bans, timber rules and other regulations. This TPP agreement is like NAFTA on steroids. This corporate tribunal bears a resemblance to the private US Supreme Court approved binding arbitration that corporations use to severely limit an individual’s or a group’s right to sue for damages. With binding arbitration we essentially have a “ private corporate court system ” outside of any government judicial system where the corporations choose the arbitrators and pay for their services. This creates an apparent conflict of interest because the arbitrators know that if they do not rule favorably to the corporations in the majority of cases, they will not be hired back.

The kangaroo courts setup by this TPP agreement will have binding corporate guarantees with both trade and cash sanctions. These cash sanctions would effectively transfer taxpayer money to transnational corporate coffers. Can you imagine the excesses we will see in the financial industry as they challenge regulations within their own private court system forcing governments to pay or eliminate them?

The kangaroo courts setup by this TPP agreement will have binding corporate guarantees with both trade and cash sanctions. These cash sanctions would effectively transfer taxpayer money to transnational corporate coffers. Can you imagine the excesses we will see in the financial industry as they challenge regulations within their own private court system forcing governments to pay or eliminate them?

The result of these corporate tribunals will be to setup a race to the bottom, where if one country chooses not to regulate something, then the corporations would be able to sue the other nations inside of the TPP to have taxpayers cover their losses for any such regulations. These other countries would be vulnerable to corporate led lawsuits to be decided in the corporate tribunals.